Generate a portfolio of solutions for a conservation planning problem by finding a certain number of solutions that are all within a pre-specified optimality gap. This method is useful for generating multiple solutions that can be used to calculate selection frequencies for moderate and large-sized problems (similar to Marxan).

Arguments

- x

problem()object.- number_solutions

integernumber of solutions required. Defaults to 10.- pool_gap

numericgap to optimality for solutions in the portfolio. This relative gap specifies a threshold worst-case performance for solutions in the portfolio. For example, value of 0.1 will result in the portfolio returning solutions that are within 10% of an optimal solution. Note that the gap specified in the solver (i.e.,add_gurobi_solver()must be less than or equal to the gap specified to generate the portfolio. Defaults to 0.1.

Value

An updated problem() object with the portfolio added to it.

Details

This strategy for generating a portfolio requires problems to

be solved using the Gurobi software suite (i.e., using

add_gurobi_solver(). Specifically, version 9.0.0 (or greater)

of the gurobi package must be installed.

Note that the number of solutions returned may be less than the argument to

number_solutions, if the total number of solutions that

meet the optimality gap is less than the number of solutions requested.

Also, note that this portfolio function only works with problems

that have binary decisions (i.e., specified using

add_binary_decisions()).

See also

See portfolios for an overview of all functions for adding a portfolio.

Other functions for adding portfolios:

add_cuts_portfolio(),

add_default_portfolio(),

add_extra_portfolio(),

add_shuffle_portfolio(),

add_top_portfolio()

Examples

# \dontrun{

# set seed for reproducibility

set.seed(600)

# load data

sim_pu_raster <- get_sim_pu_raster()

sim_features <- get_sim_features()

sim_zones_pu_raster <- get_sim_zones_pu_raster()

sim_zones_features <- get_sim_zones_features()

# create minimal problem with a portfolio containing 10 solutions within 20%

# of optimality

p1 <-

problem(sim_pu_raster, sim_features) %>%

add_min_set_objective() %>%

add_relative_targets(0.05) %>%

add_gap_portfolio(number_solutions = 5, pool_gap = 0.2) %>%

add_default_solver(gap = 0, verbose = FALSE)

# solve problem and generate portfolio

s1 <- solve(p1)

# convert portfolio into a multi-layer raster

s1 <- terra::rast(s1)

# print number of solutions found

print(terra::nlyr(s1))

#> [1] 5

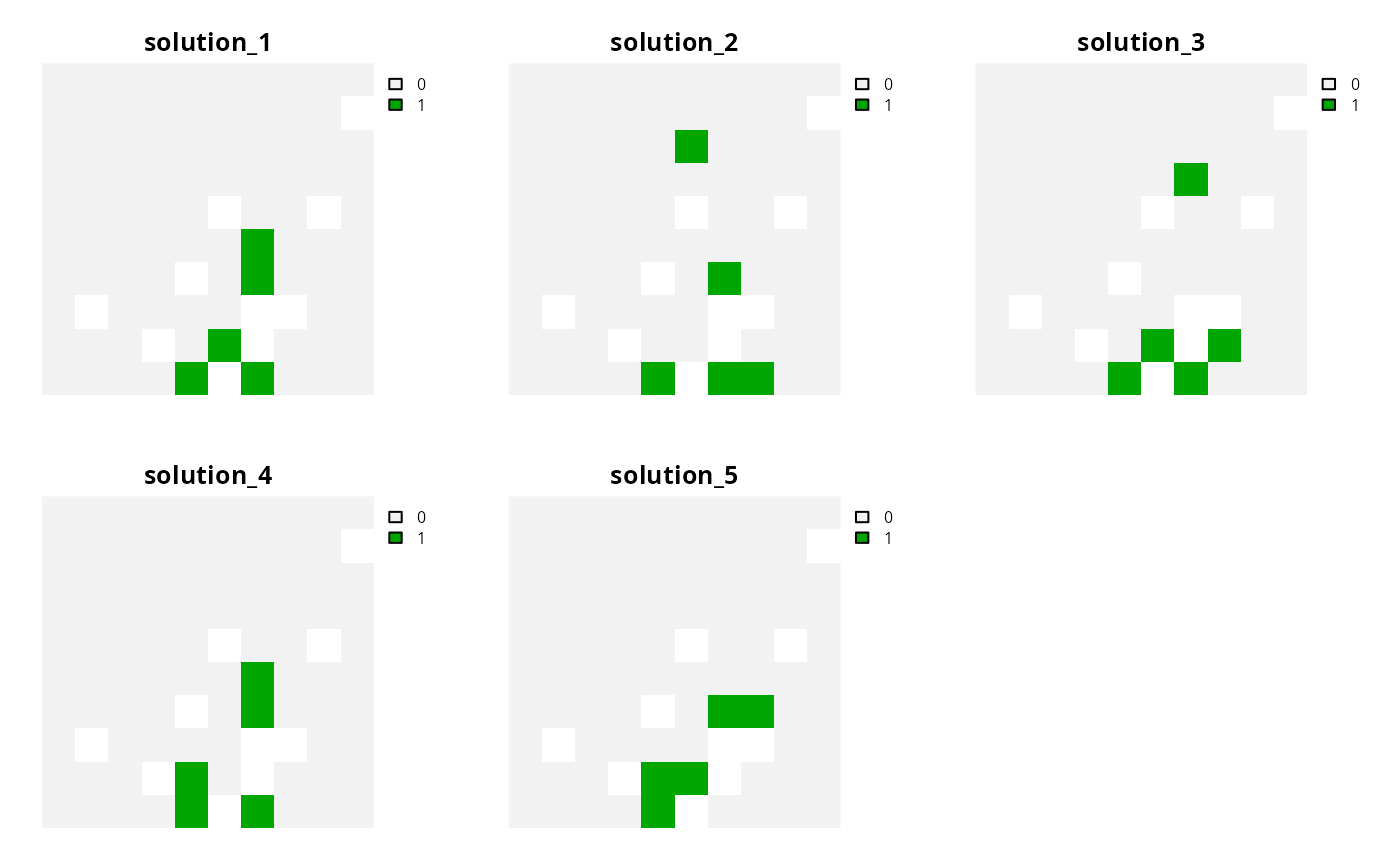

# plot solutions

plot(s1, axes = FALSE)

# create multi-zone problem with a portfolio containing 10 solutions within

# 20% of optimality

p2 <-

problem(sim_zones_pu_raster, sim_zones_features) %>%

add_min_set_objective() %>%

add_relative_targets(matrix(runif(15, 0.1, 0.2), nrow = 5, ncol = 3)) %>%

add_gap_portfolio(number_solutions = 5, pool_gap = 0.2) %>%

add_default_solver(gap = 0, verbose = FALSE)

# solve problem and generate portfolio

s2 <- solve(p2)

# convert portfolio into a multi-layer raster of category layers

s2 <- terra::rast(lapply(s2, category_layer))

# print number of solutions found

print(terra::nlyr(s2))

#> [1] 5

# plot solutions in portfolio

plot(s2, axes = FALSE)

# create multi-zone problem with a portfolio containing 10 solutions within

# 20% of optimality

p2 <-

problem(sim_zones_pu_raster, sim_zones_features) %>%

add_min_set_objective() %>%

add_relative_targets(matrix(runif(15, 0.1, 0.2), nrow = 5, ncol = 3)) %>%

add_gap_portfolio(number_solutions = 5, pool_gap = 0.2) %>%

add_default_solver(gap = 0, verbose = FALSE)

# solve problem and generate portfolio

s2 <- solve(p2)

# convert portfolio into a multi-layer raster of category layers

s2 <- terra::rast(lapply(s2, category_layer))

# print number of solutions found

print(terra::nlyr(s2))

#> [1] 5

# plot solutions in portfolio

plot(s2, axes = FALSE)

# }

# }